Finance and insurance businesses deal with high-intent inquiries—but also strict timelines, sensitive information, and heavy follow-ups. When responses are slow or inconsistent, prospects lose trust and policies lapse.

WA Chat AI™ acts as a secure, intelligent finance assistant on WhatsApp—qualifying leads, answering policy questions, and automating renewals without overwhelming staff.

Why WhatsApp Matters in Finance & Insurance

Customers prefer WhatsApp because it is:

- Fast and personal

- Easy for quick clarifications

- Less intimidating than calls

- Ideal for reminders and confirmations

Manual handling, however, creates:

- Delayed lead responses

- Missed renewal reminders

- Overloaded agents

- Incomplete customer records

WhatsApp AI automation closes these gaps.

👉 For platform fundamentals, see the WA Chat AI™ FAQ.

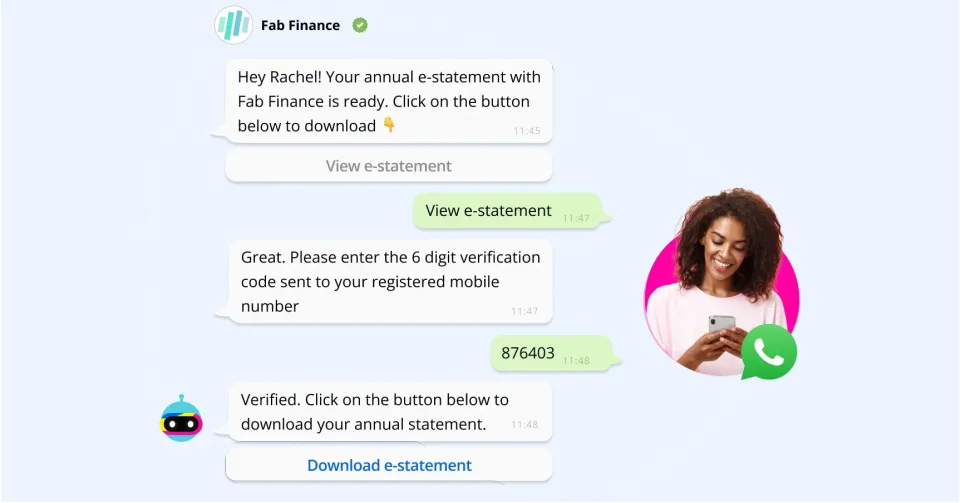

What Is WhatsApp AI for Finance & Insurance?

WhatsApp AI for finance uses artificial intelligence to:

- Respond instantly to inquiries

- Qualify prospects by needs and eligibility

- Explain products and policies clearly

- Send payment and renewal reminders

- Route sensitive cases to licensed agents

WA Chat AI™ delivers this via WhatsApp Cloud API with compliance in mind.

How WA Chat AI™ Qualifies Financial Leads

1. Instant Engagement

WA Chat AI™ responds the moment a prospect messages—critical for high-intent finance leads.

2. Smart Eligibility Questions

The AI asks structured questions such as:

- Coverage type needed

- Budget range

- Employment or business status

- Desired start date

Only qualified prospects are passed to agents.

3. Lead Scoring & Routing

Leads are tagged and routed to the right team (sales, underwriting, advisory).

Policy Support Without Overloading Agents

WA Chat AI™ automatically answers:

- Coverage explanations

- Premium breakdowns

- Claim process FAQs

- Document requirements

Agents focus on advice and closing—not repetition.

Automating Renewals and Follow-Ups

Missed renewals cost revenue. WA Chat AI™:

- Sends renewal reminders

- Shares payment links

- Confirms renewals instantly

- Follows up on inactive clients

This improves retention with minimal effort.

Use Cases Across Finance & Insurance

Insurance Providers

- Policy inquiries

- Renewal automation

- Claim guidance

Brokers & Agents

- Lead qualification

- Client follow-ups

- Appointment booking

Lending & Microfinance

- Loan eligibility screening

- Application status updates

- Repayment reminders

Investment & Wealth Services

- Product introductions

- Client onboarding

- Review meeting scheduling

Manual Finance Support vs WA Chat AI™

| Feature | Manual Handling | WA Chat AI™ |

|---|---|---|

| Response speed | Slow | Instant |

| Lead qualification | Manual | Automated |

| Renewal reminders | Often missed | Automatic |

| Agent workload | High | Reduced |

| Client experience | Inconsistent | Consistent |

Why WA Chat AI™ Builds Trust in Finance

WA Chat AI™ delivers:

- Faster responses

- Clear, consistent information

- Timely reminders

- Professional escalation to humans

See how this connects to revenue in

👉 How WA Chat AI™ Turns WhatsApp Into a 24/7 Sales Engine.

Getting Started With Finance Automation

Most finance businesses can:

- Connect WhatsApp

- Upload product and policy FAQs

- Define qualification and renewal logic

- Activate AI workflows

Go live within 24 hours.

Final Thoughts

In finance and insurance, speed and trust determine conversion.

WA Chat AI™ ensures prospects are qualified, clients are supported, and renewals are never forgotten—automatically.